Compliance in automotive retail means different things to different people. To me it simply means doing the right thing for the customers and employees. Here are four common mistakes to avoid along the way:

1. Passing the Buck

Expert lists four surprisingly common — but easily avoidable — errors and omissions dealer principals commit along the road to front-end compliance.

Get compliance right the first time by avoiding four common missteps.

Photo by stevepb via Pixabay

Compliance in automotive retail means different things to different people. To me it simply means doing the right thing for the customers and employees. Here are four common mistakes to avoid along the way:

1. Passing the Buck

The desire to do the right thing must come from the dealer principal. There are no exceptions to this rule! Dealership culture is the reflection of the dealer principal’s character. If you see value in a comprehensive compliance program, then it will be successful. If you see compliance as a nuisance, then it is bound to be ineffective or fail.

More importantly, words must match actions. For example, you cannot preach compliance and simultaneously engage in deceptive advertising.

2. Selective Enforcement

The second mistake that I see many dealers make is to selectively enforce their own policies and procedures. This is especially true when it comes to sales and F&I “superstars.” This approach emphasizes short-term gain over long-term stability. It sends a message to the rest of the team that rules do not apply as long as you “sell, sell, sell.” Remember: Words must match actions.

3. Failing to Name (or Empower) a Compliance Officer

There is a reason why every dealership has sales managers, finance managers, and service managers. Managers are held accountable for production, training, and motivation. I have never seen a successful department without a manager.

The same logic applies to compliance. You must appoint your federally mandated compliance officer to enforce corporate policies and procedures and to provide compliance training for all employees.

Your compliance officer also must have authority to apply disciplinary actions in case of noncompliant and unethical behavior. For example, if your compliance officer discovers your finance department is guilty of powerbooking cars, but can’t do anything about it, this behavior will be repeated.

4. Relying on Stair-Step Programs

I saved the most critical mistake for last. OEM stair-step programs are destroying the sales process, its integrity, and most importantly, your profits and reputation. Dealers operate in the environment of extremely high overhead and really low margins. Stair-step moneys can be the difference between staying in the black or red.

Here is what happens in a lot of dealerships at the end of the month or the end of the quarter: The factory sets a goal of 600 new-car sales in a three-month period. If you hit this number, you will receive half a million dollars.

How does this affect your sales process and compliance program? Let’s assume today is the last day of the month and you are 25 cars short.

At this point, nobody is building value in the car; they are just selling the price or the payment. Profits suffer.

Used-car customers are being switched into new cars. Profits suffer further.

You may be tempted to engage in deceptive advertising to get people through the door.

The finance department is doing whatever it takes to get customers approved and that means falsifying credit applications, payment packing, and jamming F&I products.

Your compliance officer is told to look the other way because bills need to get paid.

In my experience, abandoning your stair-step program is the most effective solution to the majority of sales- and F&I-related compliance issues. You can demonstrate commitment to compliance, enforce all your policies and procedures, and appoint and empower a compliance officer, all during the first 29 days of the month, and then watch everything go out of the window on the last day.

It happens to nearly every dealer at least once.

Max Zanan is a dealer compliance expert, an auto retail veteran, and president of Total Dealer Compliance. Contact him at max.zanan@bobit.com.

Get caught up on the most pressing legal and regulatory matters facing dealers and F&I professionals, including data security, shotgun purchases, and inconsistent payment quotes.

Read More →

Citing the issue is a strategy borrowed from the legal field itself.

Read More →

Civil penalties for noncompliance with federal auto retail and finance rules and regulations can add up quickly. Use this checklist to cover your bases.

Read More →

A dealer goodwill tale is a cautionary tale worth paying attention to.

Read More →

Frankenstein’s monster is coming for your dealership. Use this guide to recognize synthetic ID thieves and maintain Red Flags Rule compliance.

Read More →

President Trump - entropist and corporate disruptor in consumer law

Read More →

Refine and enforce your dealership’s FTC-mandated ID theft-prevention program to ensure no transaction goes awry.

Read More →

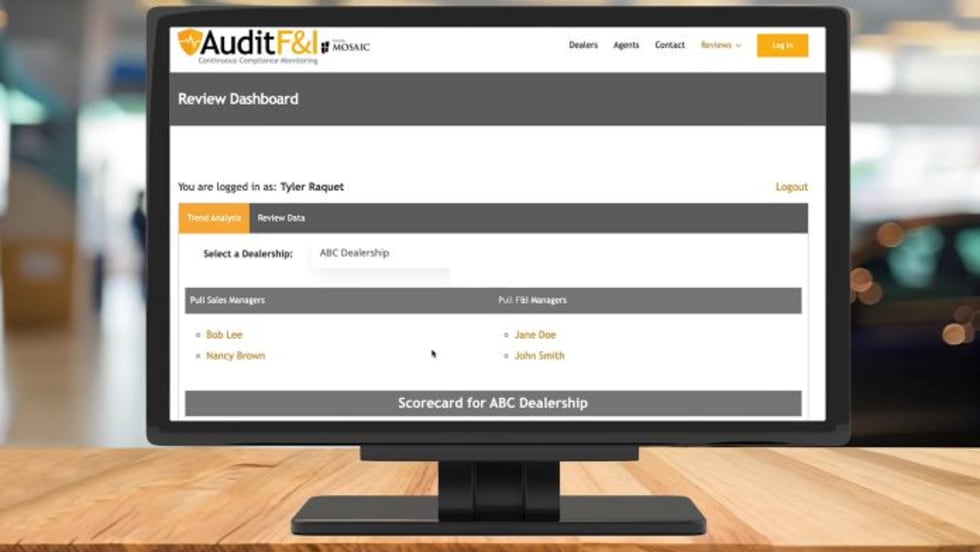

New AuditF&I platform is designed to give dealerships a smarter way to stay compliant.

Read More →