This month’s question comes from Jon in Hawthorne, Calif., home of the Beach Boys. And that’s the truth, so help me Rhonda. Now here’s Jon’s issue: “We have extremely affluent customers, and the biggest objection I get is them being able to offset the risk themselves versus relying on extended warranties, GAP or things of that nature. Do you have a strategy to overcome those objections?”

Jon, affluent customers don’t live paycheck to paycheck, so they can easily pay for that unexpected repair if and when it occurs. Hey, money may not buy happiness, but it definitely makes life easier. When you have plenty of money, you don’t have to worry about how you’re going to pay your bills this month, or pay for unexpected car repairs or a deficiency balance if your car is totaled.

So, yes, money can certainly help eliminate stress, but it doesn’t eliminate risk. In fact, the more money you have, the more likely a thief is going to try to get his hands on some of that money. And what wealthy people really hate and are always worried about is being ripped off.

Money doesn’t prevent bad things from happening, but it does allow people who have a lot of it to not waste their resources, energy or time worrying about something outside of their control. See, people with lots of money are willing to assume a certain level of risk because they can afford to, but they don’t want to waste their time. And they certainly don’t want to worry about repairs or being ripped off. Focusing on those concerns is how you can sell your products to affluent customers. Here’s how it’s done:

Customer: I’ll take my chances. Besides, if it breaks down, I can afford to fix it.

F&I manager: Well, I can certainly understand why you would want to do that. Unlike some people, if this car breaks down, you can afford to fix it. And for the first three years, you don’t have to worry about it anyway. It’s under warranty, right?

Customer: Right.

F&I manager: So if you have a problem in the first three years, you call us or the nearest dealer to have your car towed in — no matter where you’re at. You’ll get a replacement car while your car is being fixed, and you can tell them to simply call you when it’s ready. You also don’t have to worry about what went wrong, the cost to fix it, getting charged for six hours of diagnostic time, getting overcharged for labor, or having parts put on that your car doesn’t need. Just fix it, give me something to drive and call me when it’s ready, right?

Customer: Exactly.

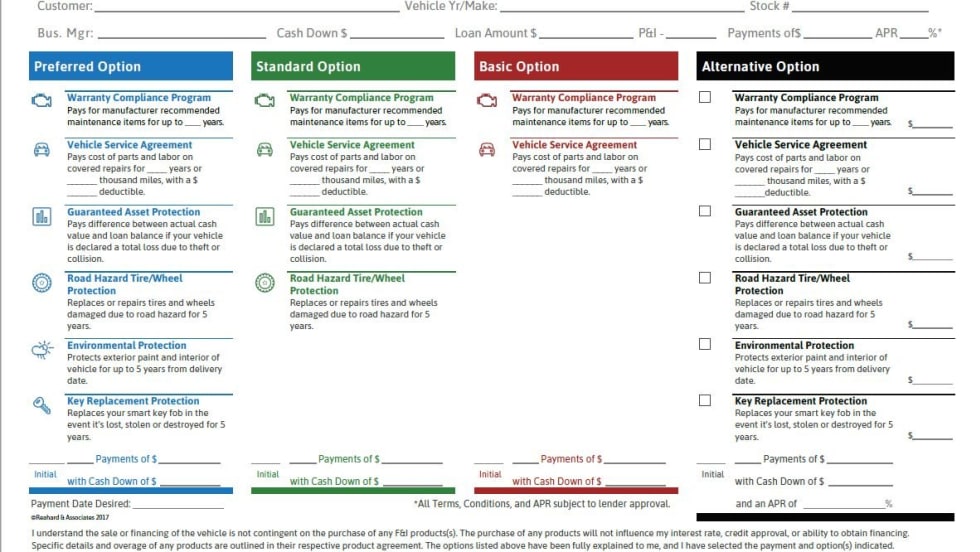

F&I manager: Well, that’s the best thing about having a vehicle service agreement: You can have that same feeling for seven years instead of three. You don’t have to worry about what a repair is going to cost. You also don’t have to spend any time or energy worrying about whether or not those repairs were really necessary or if you were overcharged, because it doesn’t matter whether that repair is $800 or $3,800. And even though you can easily afford it, you still don’t want to be taken advantage of, right?

Customer: Right.

Always try to ask a question that will elicit a “Yes” from the customer, because a positive response means you have the right to go for the close.

Our next question comes from Jon in Marion, Ill., home of the Southern Illinois Miners. Jon’s concern is, “Recently, I’ve had a lot of customers tell me they only want me to send their deal to one or maybe two banks. Is it true that a customer’s credit is negatively affected based on the number of banks I send his or her deal to?”

You can watch my video response to Jon’s question and others by going to my So Here’s the Deal blog at www.fi-magazine.com. And don’t forget to submit your own video for a chance to get your question answered and a free pass to this year’s Industry Summit (www.industrysummit.com). Until next month, remember, it’s a beautiful day to help a customer!

Ron Reahard is president of Reahard & Associates Inc., a training company providing F&I classes, workshops, in-dealership and online training. Use your mobile phone to record a brief video (shot landscape style!) of you posing your question and upload it to www.hightail.com/u/REAHARD.