MAHEIM – Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.7% from June in the first 15 days of July. The Manheim Used Vehicle Value Index rose to 221.5, which was up 13.4% from July 2021. The non-adjusted price change in the first half of July was a decrease of 2.2% compared to June, leaving the unadjusted average price up 11.4% year over year.

Over the last two weeks, Manheim Market Report (MMR) prices saw higher-than-normal but decelerating declines. Over that time, the Three-Year-Old MMR Index, which represents the largest model-year cohort at auction, experienced a 1.5% cumulative decline. Over the first 15 days of July, MMR Retention, which is the average difference in price relative to current MMR, averaged 97.8%, which indicates that valuation models are ahead of market prices. The average daily sales conversion rate of 46.7% in the first half of July declined relative to June’s daily average of 51.3% and has been lower than the typical conversion rate this time of year. The latest trends in key indicators suggest wholesale used-vehicle values should see declines in the second half of the month.

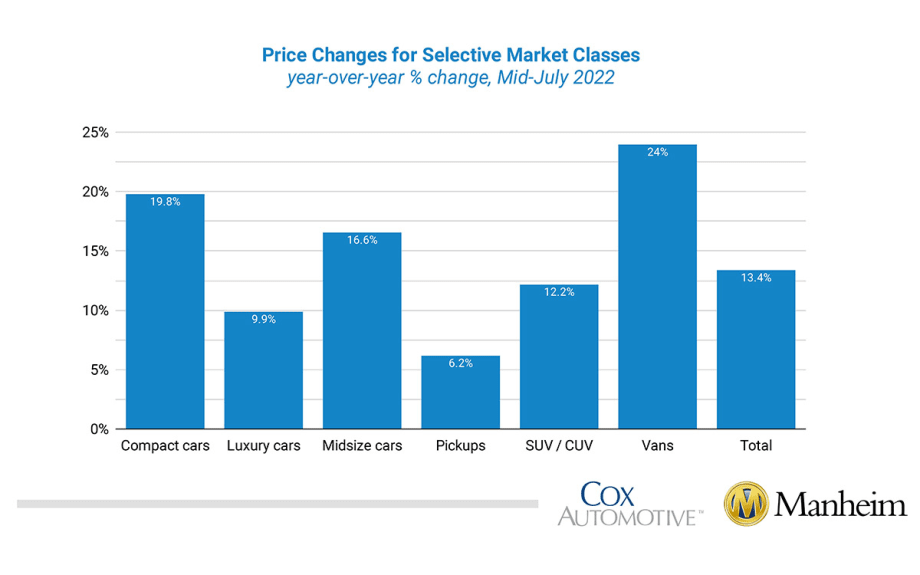

All major market segments saw seasonally adjusted prices that were higher year over year in the first half of July. Vans had the largest increase at 24.0%, while both non-luxury car segments again outpaced the overall industry in seasonally adjusted year-over-year gains. Compared to June, four of eight major segments saw better performance, with compact, full-size, and midsize cars up 2.2%, 1.9%, and 1.7%, respectively. The seasonal adjustment drove the increases, with SUVs up a slight 0.2% from June, while pickups and vans decreased 0.4% and 0.7%, respectively.

Retail and wholesale days’ supply relative normal at mid-July. Using estimates based on vAuto data as of July 11, used retail days’ supply was 47 days, which was down two days from the end of June. Days’ supply was up eight days year over year but at the same level for the same week in 2019. Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended June at 26 days, up one day from the end of May and up six days year over year. As of July 15, wholesale supply was at 27 days, up one day from the end of June and up six days year over year but three days lower than 2019.

Rental risk prices maintain year-over-year increase. The average price for rental risk units sold at auction in the first 15 days of July was up 32.9% year over year. Rental risk prices were up 0.3% compared to the full month of June. Average mileage for rental risk units in the first half of July (at 57,800 miles) was down 34.4% compared to a year ago and down 1.6% month over month.

Consumer Sentiment increases to start July. The initial July reading on Consumer Sentiment from the University of Michigan increased 2.2% to 51.1. The improvement was from consumers’ view of current conditions as future expectations declined slightly. Also notable, the expected inflation rate in five years fell to 2.8% from 3.1% in June. Consumers’ views of buying conditions for vehicles increased to the best level since April. The daily index of consumer sentiment from Morning Consult has also increased so far in July. The index is up 0.3% for the month so far. Sentiment has improved as gas prices have been falling. The average price of unleaded nationally was $4.52 on Sunday, down 9.9% from peak in June.

Click here to view the full report.