Accuity and LexisNexis Risk Solutions announced they are merging operations. Both businesses are RELX companies and leaders in their respective focus areas in the global financial crime compliance sector with complementary solutions. Accuity is part of the LexisNexis Risk Solutions group of companies (LexisNexis Risk Solutions Group). The companies operate in more than 100 countries.

In today's evolving world of financial crime and risk, there is a growing industry-wide requirement for compliance, risk and payments solutions that seamlessly use and integrate with comprehensive, trusted and in-depth data sets.

LexisNexis Risk Solutions is the trusted data analytics provider for organizations seeking actionable insights to manage risks and improve results, delivering targeted solutions that empower well-informed decisions while upholding the highest standards for security and privacy. Accuity powers compliant and assured client transactions to help build an interconnected and trusted financial ecosystem through financial crime screening, global payment services and financial asset verification and fraud prevention solutions for government benefit programs.

Aite Group senior analyst Colin Whitmore, stated, "In today's evolving world of financial crime and risk, there is a growing industry-wide requirement for compliance, risk and payments solutions that seamlessly use and integrate with comprehensive, trusted and in-depth data sets. The combined offerings of Accuity and LexisNexis Risk Solutions financial crime compliance and risk offerings promise to meet this growing need."

Rick Trainor, CEO of LexisNexis Risk Solutions, Business Services, said, "Accuity is an excellent strategic fit for our business. Both companies share a common vision – enabling financial transparency and inclusion around the world using innovative technology and comprehensive data to help our customers control risk, enhance and empower compliance and optimize business processes. The Accuity suites for payments and compliance professionals will complement our existing global solutions, including Financial Crime Compliance and Fraud & Identity Management."

Benefits:

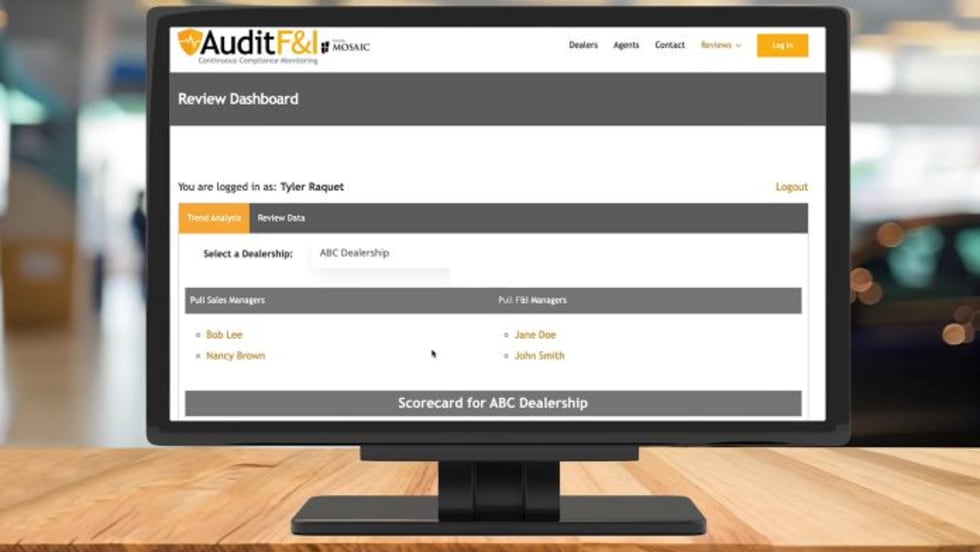

Combined solutions further leverage and extend high-value data and analytic capabilities from both companies to provide comprehensive risk management and payments solutions.

Future integrated offerings will better address critical customer needs across Know Your Customer, anti-money laundering and payments by providing more comprehensive global solutions to address the sophisticated and evolving methods criminals use to commit financial crimes.

Combining two differentiated and distinct data sets will enrich a joint product suite to drive greater customer value by enabling more actionable decisions through effective customer portfolio monitoring.

The combined organization will create one of the largest global providers of compliance risk solutions.

Haywood Talcove, CEO of the Government group of LexisNexis Risk Solutions, added, "Combining Accuity's benefit eligibility compliance solutions with our fraud and identity offerings provides even greater stewardship opportunities for our U.S. federal and state government customers. Our combined solutions will further improve efforts to effectively fight fraud, waste and abuse across a vast array of programs like Medicaid, Unemployment Insurance, Temporary Assistance for Needy Families, Supplemental Nutrition Assistance Program and other food and housing programs."

LexisNexis Risk Solutions and Accuity will conduct business as usual in the short term while integration progresses.