MCLEAN, Va. — June was an especially strong month for the used-vehicle market, resulting in J.D. Power Valuation Services’ Seasonally Adjusted Used Vehicle Price Index increasing 1.2 points from May to 118.2. Compared to a year ago, the index was up 4.1 points.

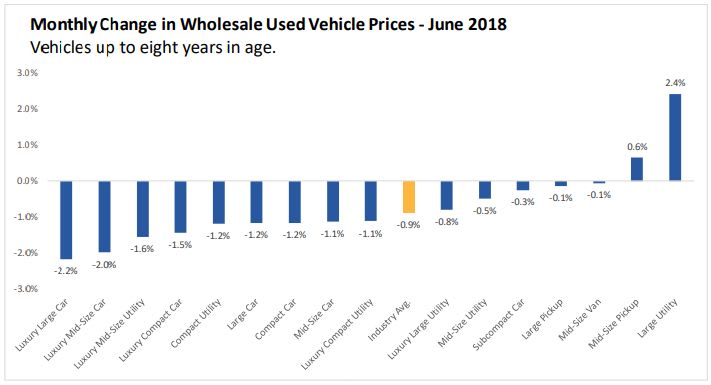

Over the last five years, June losses have averaged 2.2%. This June, wholesale prices for used vehicles up to eight years in age fell by 0.9% compared to May.

“Losses at the segment level were less than historic norms across the board on both the mainstream and premium sides of the market,” the firm noted in its monthly report. “Midsize pickups and large utilities segments returned the best performance for the month.”

Following the positive trend the firm observed over the past several months, midsize pickup prices increased 0.6% — the segment’s best result since 2009. This is despite the past five years’ price movement for this segment being flat to down slightly.

After declining 6.3% in May, large utility prices bounced back slightly in June. “This was the first time in 2018 that prices for the segment increased and the group’s best showing for the period in 2018 that prices for that segment increased and the group’s best showing for the period since 2009,” the firm noted in its report. “However, when looking at month-over-month price movement for this group, it’s important to remember that the overall sample size is small compared to others. So any material change in prices is amplified.”

At the opposite end of the spectrum, premium segments recorded some of the largest losses for the month. Large premium car and midsize premium car prices fell by more than 2%, following closed by midsize premium SUV and compact premium car with losses of 1.6% and 1.5%, respectively. However, losses observed in these segments were less than what’s typically recorded for the period, the firm said.

Looking at auction trends, volume for units up to five years in age declined 16.3% compared to May and 2.8% from a year ago. As a result, year-to-date later-model volume now sits 2.3% above year-ago levels and continues to increase with each passing month.

“At the segment level, some of the largest volume increases are still observed among SUV segments,” the firm said. “Compact premium SUV volume is up 53.3% and large SUV volume is up 26.3%. In terms of volume share, cars reached 52.2% and trucks are at 47.8%.

“Overall, we are anticipating a 6.5% increase in supply for vehicles up to five years in age this year, which is slightly less than the 6.6% increase recorded in 2017,” the firm added. “We believe that most of this year’s increase will be driven by a 14.2% increase in off-lease volume followed by an 8% increase in rental supply and 2.7% increase in regular retail purchase supply. Supply is expected to peak in 2019 before leveling off.”

Looking ahead, the firm expects July wholesale prices of vehicles up to eight years in age to decline by less than 1%. As for the firm’s full-year forecast, it expects used prices to increase by approximately 1% in 2018, up from the 0.8% forecast it reported last month.

“Negative forecast factors hurting used vehicles continue to be incentives, an anticipated increase in used supply, worsening credit conditions and increasing gasoline prices,” the firm noted in its report. “However, positive factors (e.g., favorable labor conditions, strengthening housing prices, long-term quality improvements) will outweigh the negatives.”