DENVER — Launched in 2016 as a peer-to-peer ecommerce solution, Blinker this week said it's expanding its proprietary ecommerce and loan origination platform into two new states and has teamed with Ally to offer F&I protections to users of its mobile app.

Blinker originally launched its solution in Texas and Colorado. It now adds the two largest vehicle markets in the United States with its expansion into California and Florida. The startup has helped private sellers earn an average of $2,900 over trade-in, saved buyers an average of $2,000 below dealer retail value and saved customers who refinanced an average of $130 per month on their car loans, the company claimed in its press release.

The startup’s expansion means it is quickly positioning itself to take on private-party marketplaces like Craigslist, Letgo, Autotrader, Cars.com and Facebook Marketplace, which have a national reach but don’t offer services such as integrated financing or lien payoff support.

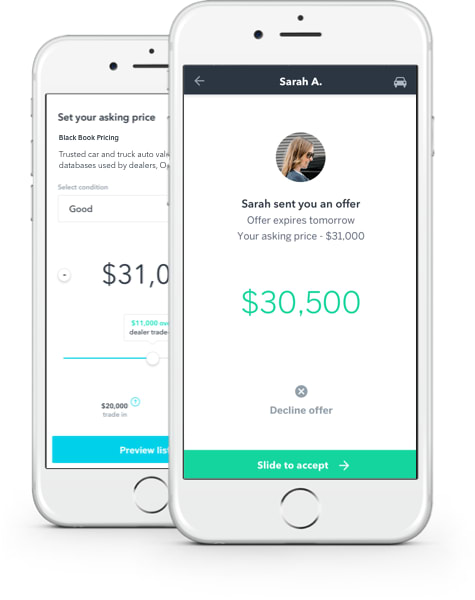

Blinker provides an end-to-end solution for anyone buying, selling, financing, and refinancing cars. According to officials, the platform’s artificial intelligence-powered vehicle recognition technology makes getting prequalified for financing or selling a vehicle as easy as snapping a photo.

The company verifies the identity of every buyer, seller and vehicle, and also securely transfers funds and even assists with DMV paperwork. The company is led by a team of automotive, technology and finance industry veterans from US Bank, CarMax, GM Financial, and Cox Automotive, and has partnerships with Carfax, Black Book, and Ally.

The latter, the startup also announced, will now give Blinker users the option to add its vehicle protection protects to their deals, including Ally GAP and Ally Premiere Protection vehicle service contracts. “Ally is thrilled to work with Blinker, a cutting-edge trailblazer in the automotive digital space, to offer our industry-leading vehicle protection products that provide consumers with peace of mind,” said Doug Timmerman, president of Ally Insurance. “Like Blinker, we’re committed to being customer-centric and innovating in the marketplace.”

Blinker’s mobile app was a 2017 recipient of a South by Southwest Interactive Innovation Award, earning the recognition in the competition’s New Economy category. It was also a finalist for the 2018 LendIt Fintech Industry Award. Since launching, the company has secured 13 patents and generated more than $44 million in vehicle sales, according to officials.

“Blinker is on a mission to change the way people manage their vehicle ownership — putting them in control of the entire process right from their smartphones,” said Blinker founder and CEO Rod Buscher, a 35-year industry veteran who founded John Elway Dealerships in Colorado. “By expanding our financing and refinancing services, as well as our strategic partnerships with Ally to the largest car markets in the nation, Blinker is proud to empower more drivers than ever.”