BLACK BOOK – Wholesale Prices, Week Ending July 2nd

With the exception of the Compact and Full-Size Van segments, all segments reported softening last week, leading up to the July 4th holiday weekend. In recent weeks, the sales rates at the auctions have been trending downward and dealer sentiment is that leads have softened, so it is no surprise that the overall market has now reported declines for two consecutive weeks.

This Week Last Week 2017-2019 Average (Same Week)

Car segments -0.11% +0.16% -0.30%

Truck & SUV segments -0.16% -0.11% -0.15%

Market -0.15% -0.02% -0.21%

Car Segments

On a volume-weighted basis, the overall Car segment decreased -0.11%. For reference, the previous week, cars increased by +0.16%.

All nine Car segments decreased last week.

After fourteen consecutive weeks of increases, Compact Cars declined -0.11%. Sub-Compact Cars also ended a streak of increases, with a decline of -0.05%.

The Prestige Luxury Car segment led the Car segment declines last week, with a depreciation of -0.36%. The Luxury and Premium Sporty segments also had large declines of -0.25% and -0.23%, respectively.

Truck / SUV Segments

The volume-weighted, overall Truck segment decreased -0.16%, compared to the prior week’s increase of -0.11%.

Ten out of the thirteen truck segments reported decreases.

Supply is still tight in the Compact and Full-Size Van segments which is evident in the wholesale trends for these vehicles, with values continuing to increase when the rest of the market is reporting stabilization and/or softening.

The volume leading truck segment, Compact Crossovers, declined for a second week in a row, -0.21%, compared with -0.15% the previous week.

Full-Size Pickups declined -0.12%, compared with the prior week’s decline of -0.09%.

Weekly Wholesale Index

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last 2 years. We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for the majority of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December, reporting over 1.51 points. Now, in calendar year 2022, the index has been reverted back to the 1.00 mark. Overall wholesale prices have increased over the last several weeks and they now sit just above where the year started.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Retail (Used and New) Insights

As of July 1, second quarter new vehicle sales fell roughly 25%, as many OEMs continue to face supply chain disruptions. AutoForecast Solutions is now estimating 2.5 million vehicles globally have been removed from production plans for this year, due to the ongoing microchip shortage.

Volkswagen’s ID Aero, an electric mid-size sedan, will be released into the US market, but timing has not been confirmed.

Toyota has now exceeded the 200,000 vehicle mark for vehicles eligible for the $7,500 electric vehicle tax credit. They now join Tesla and General Motors that have also sold more than 200,000 electric or partially electric vehicles and they will begin to phase out the tax credit.

Used Retail Prices

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.

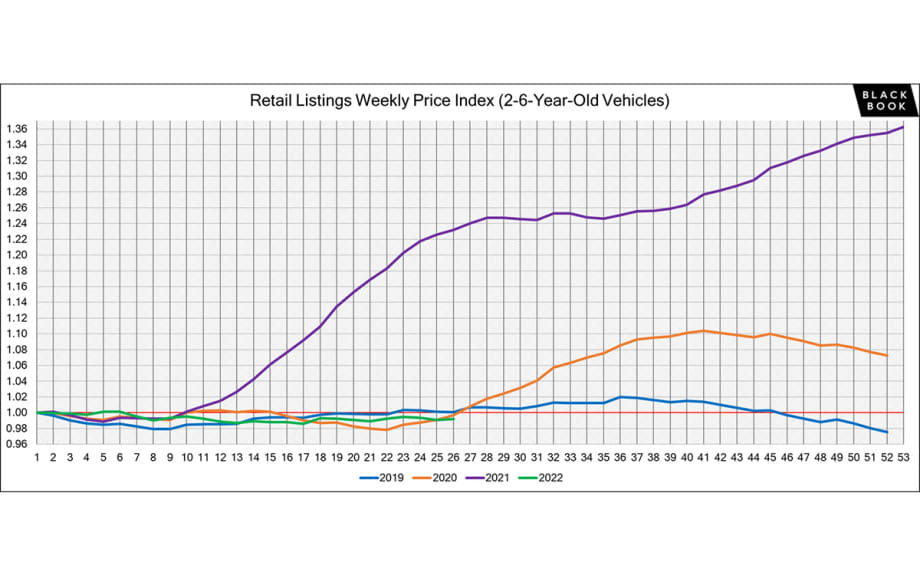

At the on-set of the pandemic, in CY2020, used retail prices increased slightly, following typical seasonal patterns, and then began dropping in April, finally hitting a low point in the late spring months. By late summer of CY2020, Used Retail Prices increased as supply of new vehicle inventory started to become scarce, but retail demand slowed down at the end of CY2020, resulting in declining retail asking prices for the last several weeks of the year. When CY2021 kicked off, demand rebounded while retail prices lagged slightly behind wholesale prices; March of 2021 started the dramatic increases in Used Retail Prices, fueled by stimulus payments, tax season, and shortages of new inventory. During the third quarter, retail prices continued to rise at a slower rate but soon picked up the pace once again, to start the fourth quarter. In Q4, prices on retail listings steadily increased week after week. As CY2021 came to an end, the retail listing price index closed 36% above where the year began.

So far in 2022, the Retail Listings Price Index has remained relatively unchanged, The Index sits around 0.99, indicating a very slight decrease in retail pricing. Typically, there is a lag between changes in wholesale prices and retail prices.

This analysis is based on approximately two million vehicles listed for sale on U.S. dealer lots. The graph below looks at 2-6-year-old vehicles. The Index is computed keeping the average age of the mix constant to identify market movements.

Inventory

Used Retail

Used Retail Listing Volume has increased again and is now reporting at the 1.05 mark.

The Used Retail Days-to-Turn Estimate now sits at 37 days.

Wholesale

The wholesale channels have remained consistent this week, with newer used vehicles continuing to be in strong demand. Some clean 2022 model year vehicles are popping up in the lanes with very low mileage, while model year 2023 vehicles are getting ready to come out. Buyers are in the lanes and are persistent, but the sellers are holding to their ground and not lowering their floors, therefore, sales rates have declined. Large independent dealers and rental companies were still making an appearance last week, making the competition for small and franchise dealers even higher.

The vehicle segments continue to follow the prior week’s turn in going into negative territory. While Compact Vans are still on the rise, Compact Cars joined the negative territory this week. We are slowly seeing a continual decrease in Prestige Luxury and Luxury cars, Full and Mid-Size Crossovers, Compact Crossovers, and Minivans. We can expect this trend to continue until gas prices stabilize.

The Estimated Average Weekly Sales Rate continues to drop and is now at 66%, after several weeks of increases this spring.